In this article, the tough questions are going to be answered. You are going to learn all about the various pricing, and offers available to you when selling your property, so you can determine which option is going to be best for you.

Spoiler alert: It’s not always the offer with the highest price!

Some of the areas we will be touching on are:

You’ve lived in your property for years and your neighbours/Friends and Family have always been there. They feed your pets when you’re away, they bring your rubbish bins in, they even bring over a leftover birthday cake! But will they be the best buyer for you?

And why would your neighbour want to buy your property?

Why would a Developer/builder want to buy your property?

Why would a Non-commercial buyer/TradeMe want to buy your property?

Why would a Private house buying company want to buy your property?

Valuation sites online: (homes.co.nz, qv.co.nz, Trademe.co.nz, Oneroof.co.nz) – These are the first port of call for your standard home buyer looking to purchase a property. These sites come with pitfalls as they are only based on your Rateable Value and nearby sales in your area. They don’t take into consideration any upgrades or circumstances of recent sales. Certain sites can also be edited by real estate agents.

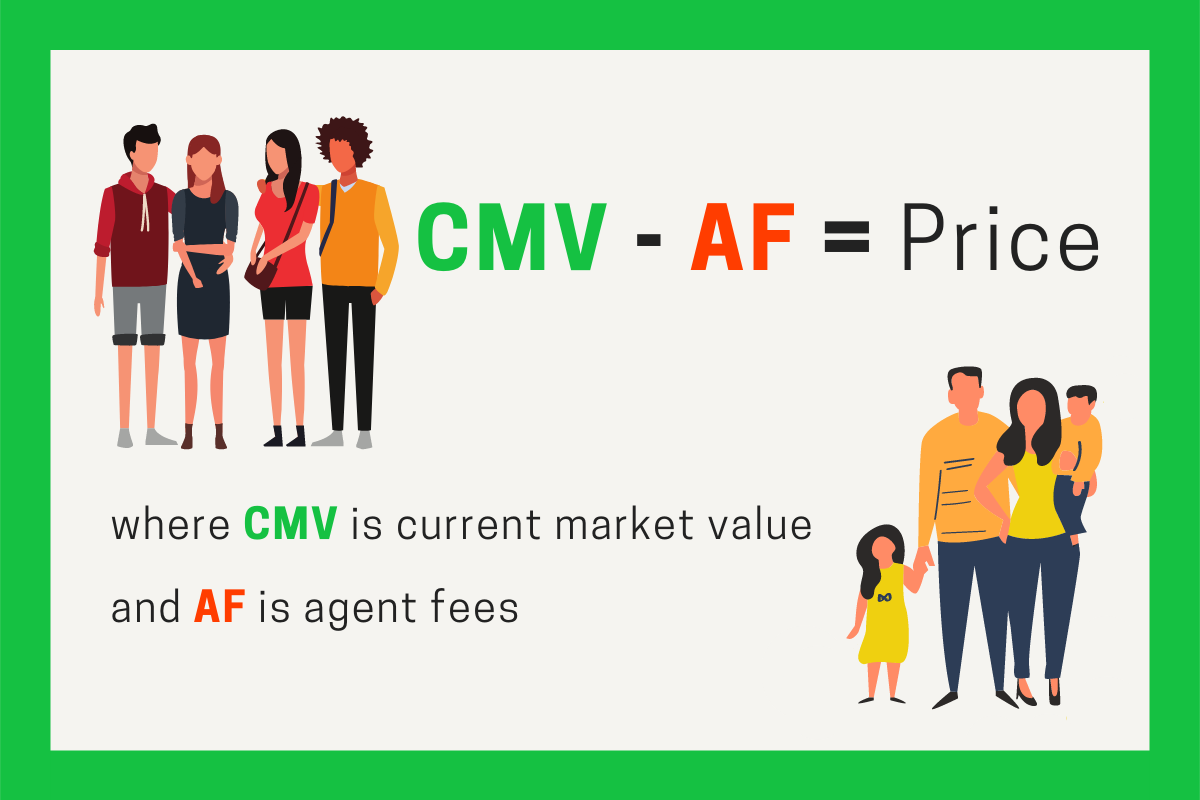

Real Estate Agent Comparable Market Analysis: This is an excellent way to get an overview of the area and the market through an industry professional comparing your property to recent sales in your area. The data you will be shown will be up to date and of comparable properties in terms of quality and size. The estimate you will be left with is at the real estate agent’s discretion, so watch out for under and overpricing.

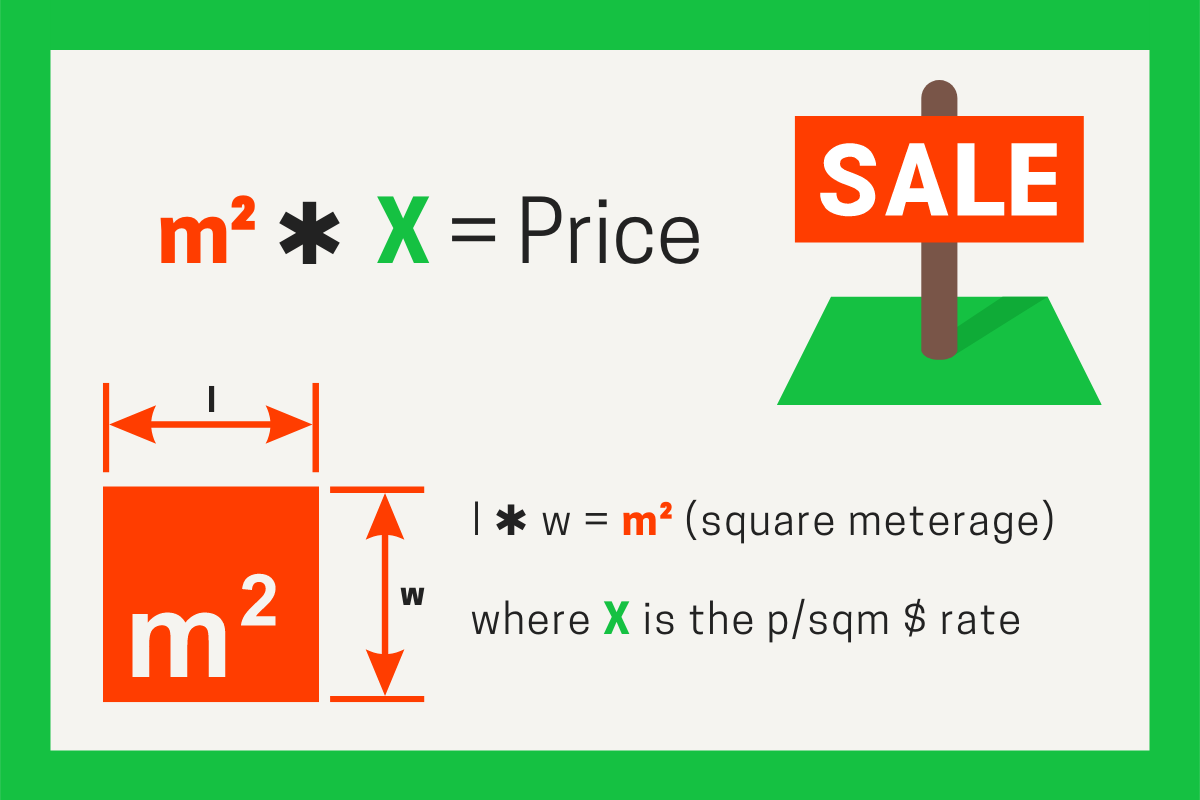

Rateable Value (Ballpark): Once upon a time in a market that wasn’t so hot, Rateable Value was a good indication of what a property may potentially sell for. If it was renovated it may achieve slightly over Ratable Value, and if it needed some love the price may fall below the Rateable Value. The issue with Ratable Value is that it is a value that is made to determine your rates. It is based on where your house is located, the floor area and the land area. This doesn’t take into consideration the current condition of the property and current market conditions.

Valuation (Unquestionable and at a cost): A property valuation is undertaken by a registered property valuer who will be certified by the Valuers Registration Board. It is an independent assessment of the value of your property based on several different factors and should be a non-biased opinion based on data. This comes at a cost anywhere from $600 – $1000 depending on what company you use.

There are several professionals in the industry who can supply you with relevant reports so both buyers and sellers can make informed decisions. Sometimes these reports are commissioned by the sellers and sometimes it is up to the purchasers to undertake their own investigations. Some examples:

Building Inspections Report: A Building inspection reports include visual inspections of a building, such as the interior, exterior, outdoor, roof and site areas. General inspections of a house’s plumbing, moisture and electrical conditions are also reported. Usually, a ‘Registered Building Surveyor” or a qualified building inspector with similar qualifications and training will undertake these inspections. These vary in cost depending on the size of your house. Generally ranging from $400 – $1000

Weathertightness report: If your home was built in a certain era, or constructed with a high-risk design and material you may wish to get a weather tightness report to eliminate any moisture ingress concerns. These can range from thermal imaging to invasive moisture testing. These can vary in price from $500 – $1500

Engineering Report: An engineering report is a subjective report undertaken by a qualified Structural Engineer. The report will go much deeper than a building report with a focus on the major structural components of the property such as the foundation. If required the report will draw conclusions and make recommendations based on the data found. Price usually begin from $1500 +

The scope of your issues will dictate the type of buyer and price they will pay for your property. Builders, Developers and Private buyers tend to gravitate towards properties with deferred maintenance and issues as this is their area of expertise so they could potentially be your buyers. Non-Commercial buyers like your neighbours, friends and family, and buyers from Trademe are generally more interested in properties without issues as this becomes a problem when it comes to getting finance and insurance.

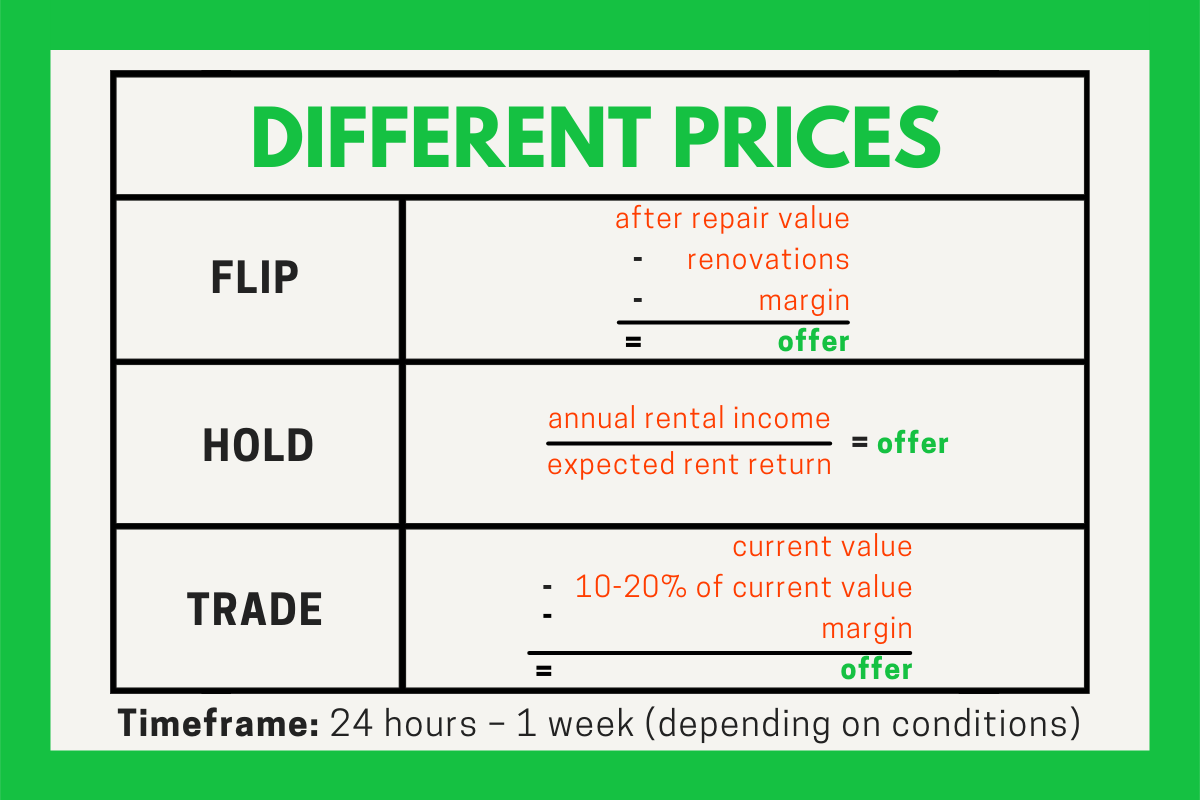

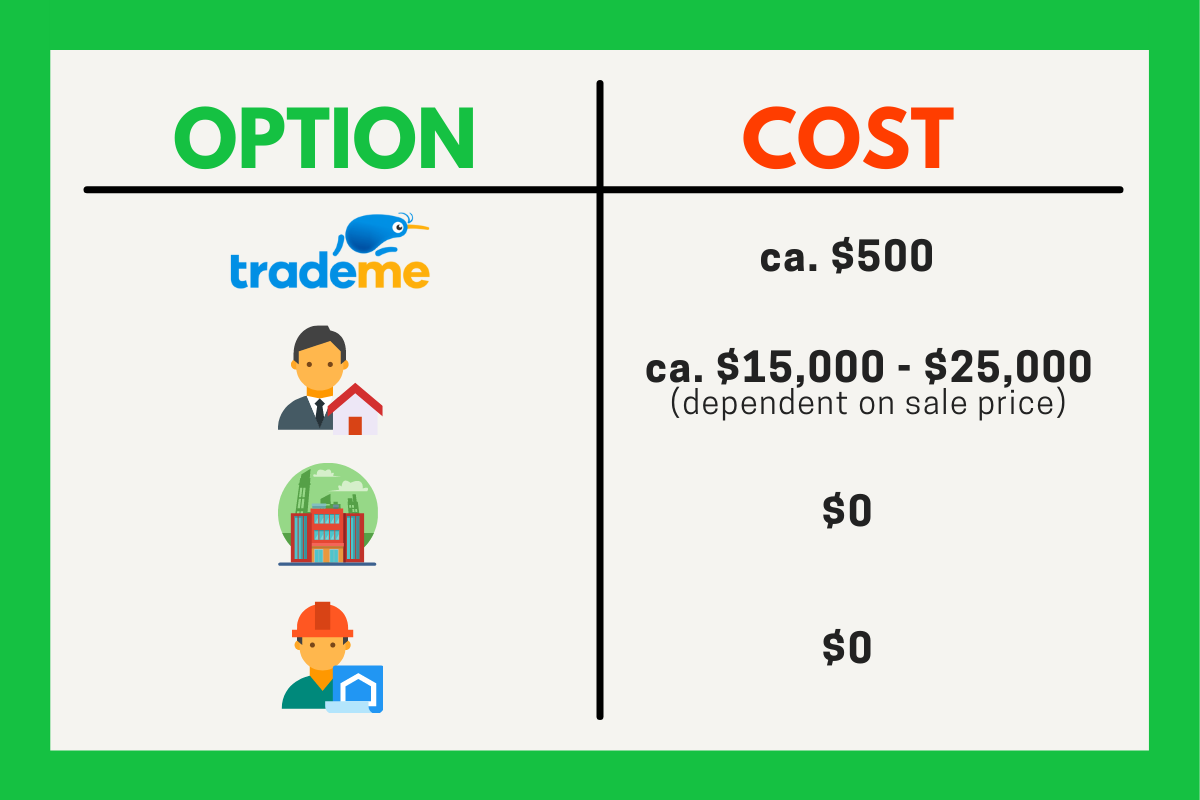

Well…..it depends. Let’s talk a look at some of your options and possible price outcomes that you may have available:

Option 1: I’m going to list my property on Trademe as a private sale

Option 2: Selling through a Real Estate Agent

Option 3: Selling directly to a family member or friend

Option 4: A developer knocked on my door and wants to develop the site

Option 5: I would like to receive an offer from a private company without any agents or fees

The best offer doesn’t always mean the best price. As you can see from the above information, depending on who is going to be buying your property, you are going to have a range of potential prices. Who the buyer also depends on how well you can negotiate. What you will find is that when you negotiate with friends and family, you’ll find it much harder to get the best price because you are emotionally involved. This is where real estate agent negotiating skills come into use as they work solely for you and have no emotional ties with a potential buyer. Their job is to get the highest price possible, and if you find a good one this can be really worthwhile, regardless of the buyer.

What do you mean, the best offer doesn’t always mean the best price?

Your Offer will consist of 3 things:

Price

Terms

Settlement date

When you go through the traditional real estate channels such as listing online and using a real estate agent you will more often than not receive a traditional buyer who will need standard terms such and finance, building report, LIM and title, and insurance.

These terms usually come with a time frame of 10 – 15 working days at which anytime the purchaser can pull out of the contract. If this does happen you will be required to find another buyer who will need to go through the same process. During which this increases the uncertainty and stress levels. If you are going down this track it is important to know that a building report will be required by the majority of purchasers. This building report usually goes to the bank for finance and if they aren’t happy with the building report they can decline the finance. So if you’re selling a property with a few issues, be sure to get these fixed up before you go to market or run the risk of having an offers fall over on the building report clause and finance clause.

Developers and private home buying companies can offer you certainty through unconditional contracts and quick settlement dates. This scenario can be ideal for sellers who need certainty in a short amount of time. Terms like these do come at a price. Typically the offers you receive will be slightly under market value. Keep in mind that there are no fees associated with these offers and the money is usually in the bank the next day. Be sure to seek legal advice before signing any sale and purchase agreements.

Every property and every seller has a different situation. Whether it is the kiwi can-do attitude of selling your house privately, employing a Real Estate agent to take your property to the market via a full marketing campaign, your property has differed maintenance or structural issues, or you’re looking to move on quickly and just want certainty there is a range of options out there for you that will produce a range of different results to suit your situation.

We would love to hear from you, let’s talk soon!

Billy

Your Property Solutions