The Ultimate Guide

To The As Is Where Is Market

The ultimate guide to selling your As Is Where Is

property in Christchurch

September 4, 2025

Contents

Introduction to the Ultimate As Is Where Is Property in Christchurch Guide

If you want to learn about selling your As Is Where Is Property in Christchurch – this is the guide for you.

What you are about to read is the most comprehensive, useful, and completely-free resource on the web that teaches you how to sell your as is where is property. Click the appropriate chapters to get stuck in.

You are reading a living, breathing article. It gets updated constantly and over time it will grow even further so it’s more interactive and comprehensive. This means adding more videos, updating case studies, including images, and deep-diving into topics.

We do this for you; this is your resource, so whenever you have a question along your investment journey you can refer back to this guide.

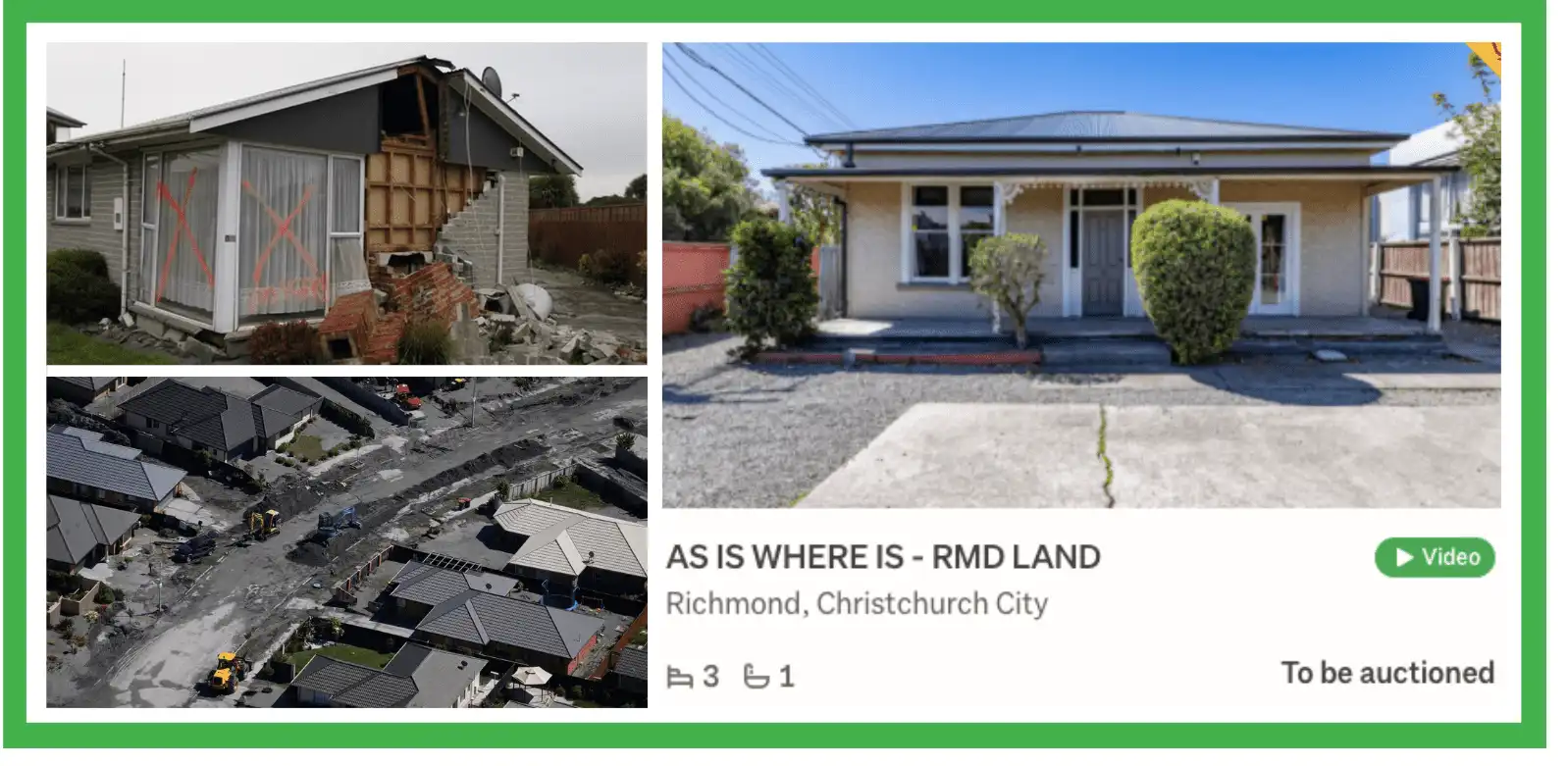

Chapter 1 – Is My House As Is Where Is?

How As Is Where Is is my property? (qualify) checklist, insurance, building code, EQC, Reports, locations.

First of all, what is an As Is Where Is property, and in particular what does that mean in Christchurch?

At first, it can be quite a confusing phrase – especially in the real estate market. Previous to the Christchurch Earthquakes, an As Is Where Is Property would typically mean a deceased, distressed, or derelict property. This definition still applies today but even more so, hence the confusion!

In the wake of the devastating 2010/2011 earthquakes that rippled through the Canterbury region and caused 16 billion dollars of residential property and land damage the term As is Where Is Property Christchurch was coined and is now code for Earthquake damaged property with no, or little insurance in place. Or also known as As-Is Property, or AIWI property for short.

Now there are a couple of things that will indicate “how As-Is your property is”

Depending on the extent of damage to your property from the 2010/2011 Earthquake sequence throughout Canterbury, you may have made a claim to EQC and your insurer for the damage, or loss that has occurred to your property. If you’re reading this and you’re still dealing with EQC, or your insurer we hope you have remained sane throughout the 10+ year process)

Throughout the process you will have been provided with a breakdown of the repair works. This will be in the form of a Scope of Works (SoW). The SoW is a detailed breakdown of the damage to the property and the recommended repair strategy in addition to the cost of these repairs.

If your EQC claim went over the cap ($100,000 + GST) and you had a significant payout from your primary insurer ($200,000 +), it is clear that your property has had significant damage.

The most important component of a house is the foundations that it has been built on. If the foundation has failed, became damaged, or is out of level, depending on the extent of this damage will dictate the amount of repair work needed to bring the property back up to the minimum Ministry of Business, Innovation & Employment (MBIE) guidelines. . The maximum tolerance for maximum floor level variation under today’s building code is 50mm over 0.5m.

You may already have a structural assessment report prepared by a structural engineer provided by your insurance company. You’ll find that hidden in the pile of insurance documents provided to you. If you don’t, you can get an LBP builder to take levels for you, or engage a professional engineer to conduct a full assessment.

You may have a concrete foundation or ring and pile foundation. If you are unsure, take a look under your house. Here are a few hints to help you out:

If your house has a manhole to the subfloor you will most likely have a wooden suspended floor that’s supported by a concrete ring.

If you were to pull up your carpet anywhere in the house and see concrete underneath you are most likely to be on a concrete foundation!

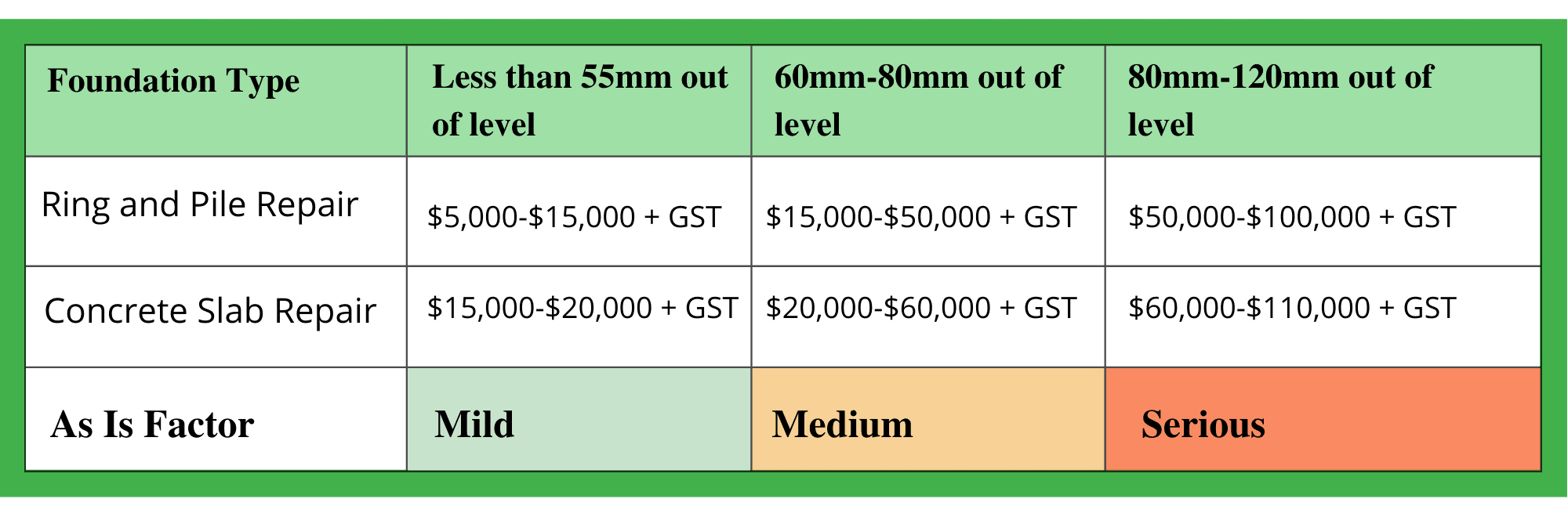

The table below is a reference as to how we look at and estimate foundation repairs, these figures may change over time. We have a dedicated construction team that rinses and repeats the leveling process – these figures are not actual quotes, only guidelines to give you an idea.

Now you have determined where your foundations are at, you need to assess the rest of the house and add that to your calculations – most of which can be easily quoted by professionals (for free!).

Keep in mind that if you’re re-leveling your house by more than 60mm your walls, ceilings, tiles, cladding & windows are going to sustain cracking and damage as a result of the lift. Always assume that the entire interior and exterior is going to need to be replastered and repainted – however, if your foundation damage is less than 60mm out of level you may get away without the painting. This is highly dependent on the methodology of the re-leveling and how far you want to take your renovation.

Other building & renovation items to consider:

- Painting & Plastering interior and exterior

- Driveway and paths

- Roof replacement

- Flooring replacement

- Drainage

- Electrical disconnect and reconnect

- Plumbing disconnect and reconnect

- City council exemption and paperwork

There’s a lot to take into consideration when assessing the damage and what will be the best way forward for you and your as is where is property.

One thing we can’t stress enough is thinking about the time and effort involved in going forward with a self-managed repair. If you and/or your partner are in full-time work, we suggest hiring a project management company to deliver the project for you. Why?

There’s nothing worse than dealing with the ongoing stress and responsibility of a project, especially if:

- You have never managed a repair project before or,

- Don’t have the time to do it.

You only get one chance to do it, so whether you pay the extra for a professional to handle it, or you decide to run it yourself you’ll find at the end of the day it will end up costing the same. Who do you think is going to deliver the better result? We will leave that one for you to decide

Now that you can understand the extent of the damage you can now make better assumptions on what to do next. Whether that’s managing the repair yourself, hiring a professional to take care of it, or keeping the cash settlement and selling your place As Is Where Is.

Chapter 2 – What Are My Options For Selling An As Is Where Is Property?

The good news is that there are a few paths you can take when it comes to selling your As Is Where Is property. There is the traditional route where a real estate agent can list and sell your As-Is Where is property on the open market. In addition to this there is the OFF market option where you deal directly with As Is Where Is Buyers who are private buyers. You can choose whether you want to deal directly, or use a middleman (agent) to do the work for you. We will go deeper into the various selling options soon, but first you need to ask yourself..

What is your desired outcome?

It could be, “I want my house sold for the highest price”, or “I want my property gone yesterday”, OR it could be “I can’t stand real agents although I want a good result” or it could be “I just want an idea on what someones willing to pay!”

It’s probably a mixture of all of them, however, beginning with the end in mind is always a good place to start so when it comes to making a decision be sure you stay aligned with your goals.

The scenario of selling through a Real Estate Agent

A Real estate agent will provide you with a market appraisal – a breakdown of recent properties sold. They will then use this data to try and determine what they think your property will sell for.

This can be a worthwhile task – it’s free but you need to ensure that all of the comparable sales are actually As Is Where Is properties. If they are not then the data will not be accurate and your appraisal is essentially cooked – don’t be fooled for high priced hopes at this stage in the process!

(A Real Estate Agent that promises you a price is like promising 7 days of continuous sunshine in Christchurch, it just doesn’t exist ) – you get the point.

If you are happy with the appraisal, the marketing campaign and the commission structure, you are then ready to go to market. That could be via auction, deadline sale or price by negotiation. The agent should explain which one they think is best for your property. During this process, a range of buyers of As Is Where Is properties are going to be requesting all of the relevant information such as builders report, engineering report, floor levels, EQC scope etc. It’s best to have all of this information provided to interested parties from the beginning rather than chasing your tail trying to find documents during the campaign.

This holds especially true for auctions where buyers need to be in an unconditional position to bid and therefore need to know as much as they can about the construction & damage to the property.

An agent has the ability to market your property to thousands of potential buyers through their database but there’s only a small portion of the market who are able to fund As Is Where Is properties in addition to understanding the process in order to fix them. Most people shy away from problematic properties which is understandable, and these people are no good for your campaign.

A main bank such as ANZ or ASB will not lend on a property that is uninsured and has unrepaired earthquake damage.

Remember you only need that one person to buy your property and an agent will certainly take the stress of the process away rather than you doing it yourself. As long as you are willing to pay upwards of 20K in commission in addition to 2K+ in marketing costs and ensure the house is ready for inspections at all times over the course of a 3 week campaign, listing with an agent could be an option that could be very worthwhile.

Chapter 3 – What Is The Process For Selling My As Is Where Is?

Or you can search on Google as is where is buyer Christchurch to see a wide range of companies and individuals that will buy your property directly from you. Be sure to do your research and choose the ones that are going to best suit your needs, call them for an interview or fill out a form to arrange a time to view.

The initial meeting/appraisal should take 15 – 20 minutes and it involves showing the buyer around your property and giving them the run down – info about the outstanding damage, what needs to be done, what hasn’t been done and so forth. This is a good opportunity for you to point out the great things about your property that they may not realize on initial inspection.

The meeting is an informal meet and greet, some buyers will make you an offer on the spot and others may need time to look over the reports before coming back to you. If you’re inviting more than one company over to conduct an appraisal it is best to keep them separate to avoid any potential awkward situations between buyers.

Chapter 4 – The 7 Things You Must Know About The Christchurch As Is Where Is Market

Not all Real Estate Agents understand the ins and outs of the niche As Is Where Is Market

It is important to understand that when it comes to selling your as is where is property in Christchurch it’s not quite as straight forward as a regular house sale. There are agents that understand the complexities of selling these properties and there are some (quite a lot) that don’t have much of a clue.

This understanding that the agent has of As Is Where Is sales can hugely influence the result of your sale if your agent is unable to navigate buyers through the sales process. When looking for an agent be sure to interview multiple and try to find out what experience they have had in the Christchurch As Is Where Is market.

Below is our recommended list of As Is Where Is Agents in Christchurch

Main Banks and Insurance companies won’t touch As Is Where Is properties

All main banks such as ANZ, ASB, BNZ will not provide mortgages on these properties for obvious reasons, as they are damaged! Damaged properties without insurance in place equates to a huge amount of risk for the banks and falls outside of their lending criteria, and the same goes for insurance companies.

The main banks and insurance companies will not lend or insure an as is where is property without a PS4 (Sign off from engineer). In order to receive the appropriate sign offs in the form of Producer Statements all of the structural remediations need to be carried out to a level that meets the NZ building code.

However, there are always exceptions to the rule. There are second-tier lenders that will lend on these properties. You can expect to be paying an interest rate of 12% + and these loans can be extremely risky.

For insurance, you’re able to obtain contract work insurance for the construction & development costs of the project, but the house and land are still not covered under these policies.

If your agent is versed in As Is Where is property sales and fails to correctly qualify the buyers that come through your open home, it can waste a lot of time having your property under contract with buyers that don’t find out until the 10th day of due diligence they can’t obtain a loan or insurance. This can absolutely be avoided by choosing the right agent.

Most of the As Is Where Is Buyers know each other

The As Is Where Is market in Christchurch is rather tight and most, if not all of the buyers know each other, they do deals with one another and compete against the same properties over and over again.

The thing with this is that if you are talking to a handful of buyers at the same time it is quite common for the properties to come up in conversation at the pub, or over a coffee. We’ve seen in some cases (due to the good relationships between one another) they tend not to compete against each other to drive the price up, instead they often say well you take this one and we will take the next.

It may help to be selective with whom you request an appraisal from and inviting every single private buyer to your property may work against you in achieving the maximum price.

“My property is insured but there is still damage, does that make it an As Is Where Is property?”

There is a common phrase used in the property industry called a “re-repair”. This is where someone has purchased a property on the market that was deemed as fully repaired at the time of sale. As time went on the homeowners later realized that the repairs were not completed adequately and this has resulted in the property once again becoming As Is Where. Homeowners then go through the rigmarole of opening up their insurance claim, having the property reassessed and following this (and potentially lengthy battles with EQC and the insurer) opting for a cash settlement, or a managed repair.

It is unfortunate for the owners that they have to go through with the hassle of either dealing with insurance for a cash settlement, or forking out the funds to fix the property. These properties tend to be a bit of an anomaly for sellers because in most cases they are fully insured but technically not completely repaired.

What you need to know is that although the property is insured it is still As Is Where Is and when that property is sold the new owner must carry out the repairs to obtain full insurance.

The way to avoid ending up in this position is conducting thorough due diligence investigations when purchasing property (especially in Christchurch) and engaging a builder to take independent floor levels of that property.

There are still Thousands of As Is Where Is Properties

It is hard to believe 11 years on there are still plenty of As Is Where Is properties out there, albeit it peaked around 2017 – 2018. Every agent was selling As Is Where Is and every builder was snatching them up. The prolonged event of As Is Where Is properties are a result of multiple factors.

- The Fletcher & EQC program – a shambles resulting in an abundance of unqualified individuals producing scope of works documents and even worse signing off repairs. (Basically, the EQC on-sold program lead to a disastrous amount of double up repair jobs and about a billion dollars of taxpayer monies wasted)

- The Insurance companies not coming to the party and disputing the claims that came their way to reduce the enormous liability they had on their books. It was common for policyholders to be put through the wringer for 7 years straight before a final settlement was reached. Some are still fighting to this day!

- The widespread devastation of the earthquake affected 170,000 properties. It has been a mammoth task to rebuild the city and get the private sector and government sector on the same page and get on with it…..

Repairing and insuring your As Is property can be complex and risky

It goes without saying the Kiwi Do It Yourself mentality is something we see quite often in this space and that could be for a number of reasons. You may have a building background, economical reasons, you may have friends that are builders, you prefer to keep a close eye on your earthquake repairs as opposed to outsourcing it, and that’s bloody fair enough!

However – Repairing, consenting, signing off, and insuring requires a very strict process in which you must adhere to every step of the way. If you miss something or try to cut a corner in order to save money and time it can be extremely difficult to get back on track.

What do we mean by that?

Here’s an example: Your builder friend examines your property and has a pretty good understanding of how to remediate the foundations, you know them so you trust them and agree to undertake the strengthening work.

Before work commences the original EQC scope and engineering report have not been digested by the builder and a council consent has not been applied for. But you don’t know this.

The builder chips away by jacking some piles, repairing the ring foundation and you start making progress payments because it’s coming along quite nicely.

When it comes time to get the property insured the insurance company requests the following documents:

Engineering report, EQC scope of Works, consent from Council & Sign off from engineer

You provide them with all of the original documentation, and there’s a problem…

The repairs that were carried out were not congruent with the original repair plan in the documentation…

As the builders found a more economical way to do the re-leveling (assuming all the work is up to the latest building code standards) however the insurance companies don’t see it that way.

If the repairs were not carried out as per the engineer’s recommendations and there is no council consent for the repairs there is not much hope of you obtaining insurance. You may have to re-repair the building all over again, or retrospectively apply for a building certificate of acceptance from the council. This process could take months and cost several thousand dollars. This is certainly not a situation you want to find yourself in.

It is most important that you understand the process from start to finish and have all your documentation lined up before you start. What should have happened is the following:

- Builder to review original reports

- Builder/architect to draft a set of new repair plans that include all items listed in the scope of works (a more efficient repair strategy)

- Builder to provide plans to engineer and request a PS1 (engineers brief of the new strategy)

- Engineer to submit plans to the council for consent, or exemption process

- Once approved works can begin (Highly advised not to jump the gun here)

- The engineer carries out site inspections to ensure the repairs are going to plan

- Engineer and builder signs off repairs once complete

- You send your PS1, PS3 & PS4, and consent documentation to insurance

- Providing all the docs are congruent with one another they should give you full cover

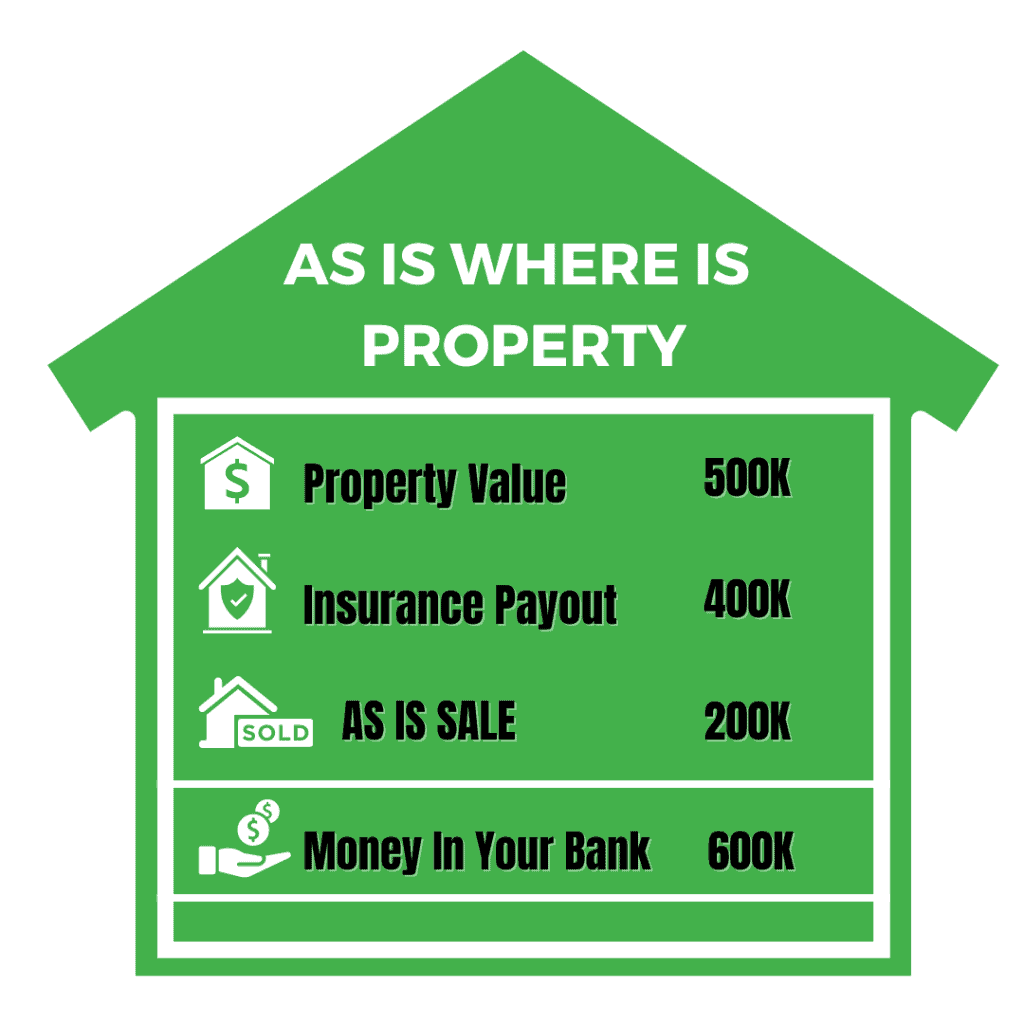

“What can I do with my cash payout?”

Once you have settled with your insurance company you could be looking to sell?

It’s important to note that the terms of your settlement will dictate what you can and can’t do with the insurance monies. It is less common when the monies are required to be used towards the repair strategy.

Otherwise, that money can be passed on to a new owner through a deed of assignment and it will be their responsibility to undertake the repairs.

9 times out of 10 we see people settle with their insurance company, take the cash and then sell the remaining uninsured house and land As Is Where Is.

This option leaves them with more in their pocket

Here’s an example:

- Going through with the time, costs and risks of a managed repair of your property

- Cashing out and buying something that’s completely done and most likely an upgrade

Chapter 5 – Who Are The Different As Is Where Is Buyers In Christchurch? (With Reviews)

You will find a wide range of As Is Where Is buyers in Christchurch if you just simply started on google. Now before you start arranging appraisals you want to have a fair idea on who is going to be the best fit for you, and not only who is the best company to work with but also which TYPE of As Is Where Is buyer is going to be most suitable for you.

We secret shopped the following companies that had the top 3 spots after a google search, and rated them out of 5 for each category with some commentary

Level of offer and terms

Information

Responsiveness

Level of offer and terms

Information

Responsiveness

Level of offer and terms

Information

Responsiveness

-

Developers/Builders

A developer or builder is seeking opportunities to buy strategic land parcels to build and deliver their product to the market. These buyers will make an offer on your property based on a per square meter rate and/or the total land value less demolition costs. Developers tend to want extended or long settlements due to planning permission time frames from the council, if your land is zoned high density or perhaps it is on a corner site a developer may be willing to pay a premium for this because of the value they can extract once they have completed their development. Developers can be easy to deal with in the sense that they may not need to view the property in person or need any of the EQC or structural information.

-

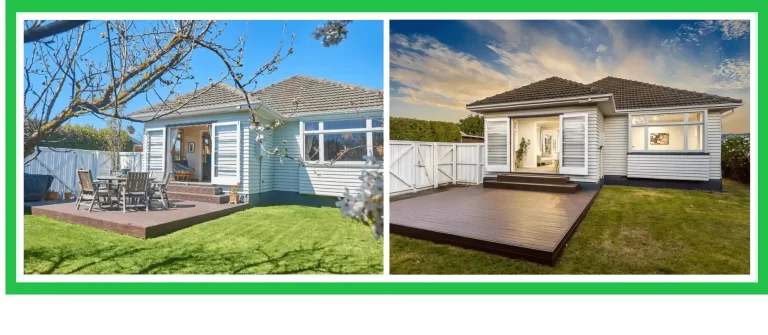

Value Add/Investors

A value add investor is a buyer who is looking to buy, fix and flip a property. These buyers are looking to purchase As Is Where Is property to make a margin by buying below replacement cost, investing time and money in a repair and selling on the market in a short time frame. The majority of the As Is Where Is buying companies fall under this category. The reports and documentation are important to this crowd as it allows them to ascertain the repair costs before making their As Is Where Is offer. Value add investors can settle transactions promptly as the profitability of this business relies upon velocity of capital and volume of transactions.

-

Buy and Hold/Landlords

The buy and hold As Is Where Is buyer is seeking more of a long term strategy that is predicated on cash flow, and rental yield. An opportunity to purchase an As Is Where Is property below replacement value and renting it out can make for an attractive yielding investment. Some of these buyers may not even carry out the repairs and retain the property uninsured, others will carry out the minimum structural work to obtain insurance and continue renting. A rental appraisal can assist these buyers in making a decision, as well as all of the other EQC documentation. If your As Is Where Is property is a multi unit property or a boarding house these are the buyers you most likely will be dealing with.

Chapter 6 – How Much Money Will I Get For Selling As Is Where Is Property? (Case Studies)

This is the most important question in the equation when it comes to selling your As Is Where Is property. Due to the nature of the real estate market, there is no one size fits all as every property can be so different. Unfortunately we do not have a crystal ball but we do simple formulas that are used to calculate an As Is Where Is offer. These formulas are used across the board with most buyers and could be helpful to you in making your decision.

Value Add investors/Flippers

After repair Value – Total development costs – profit margin = Your Offer

Developers/ Builders

Square meterage of Land x Going Square meter rate = Your Offer

Buy and Hold/Landlords

Annual rental income / Expected rental return or Yield % = Your Offer

Lets see how these formulas are used in real-life transactions for As Is Where Is property purchases in Christchurch.

Conway Street – Value Add Strategy

Sharne & Jeff reached out to us after finally reaching a cash settlement from their insurance company. Due to COVID 19 and the airline industry which they both worked in a job transfer was on the horizon.

Selling quickly with certainty whilst having 3 – 4 months to secure another property was what they needed.

Here’s how we formulated our As Is Where Is offer for them:

The property was originally a 2 bedroom, 1 bathroom character bungalow in original condition on a cross lease title. Following our initial viewing we ascertained that we could convert the property into a 3 bedroom, 2 bathroom property and undertake a subdivision to place the property on its own freehold title. This is in addition to completing all of the earthquake repairs and undertaking a full interior renovation. Our total capital expenditure for this property was budgeted at $150,000.

Our real estate agent believed the property would be in the vicinity of $650,000 once repairs were completed.

Our Calculation:

After repair Value: $650,000 – Repair costs $150,000 – Margin $60,000 = Offer $440,000

The owners negotiated the price and we settled at $450,000, unconditional with settlement in 3 months time. Jeff and Sharne saved $25,000 in agents fees, had zero open homes and the deal was completed in a matter of days.

Mackworth Street – Developer/Land acquisition

Michael reached out to us as he had a large 941sqm site that was positioned in the Residential Suburban Density Transition Zone (RSDT) which made this site prime for future development. Approximately 4-5 townhouses could be constructed on this site, however, the long skinny driveway was going to make things a little trickier than usual as his previous buyer (A developer) had the property under contract but canceled due to the limitations of the driveway.

Michael had found another place to buy in the meantime but his plans stalled once his original agreement was at an end, so he called us.

Our real estate agent that specializes in land development advised us of the square meter rate for RSDT in Woolston to be in the range of $580 – $680 per square meter

Our Calculation:

Square meterage of Land (941sqm) x Going square meter rate ($600) = $564,600

The square meter rate was discounted due to the fact that the driveway was not developable land and had to be excluded from the total square meterage. Our offer also contained 10 working days due diligence in the contract which allowed us to firm up our plans and strategy.

Michael wanted 6 months to find another property so we paid a large deposit upfront and settled 6 months later.

Vogel street – Buy & Hold Landlord

A body corporate manager reached out to us on behalf of 6 unit owners following a long-drawn-out process of battling with insurance and finally receiving a cash settlement for the earthquake damage to their block of flats.

The payout was going to be well over a million dollars so by selling the individual units as is where is on top of that was going to be a lucrative option for all of the existing owners. We managed to get through each unit, look over all of the reports and make a prompt offer.

One of the unit owners wanted to remain in place and fix their portion of the building. We negotiated a deal whereby we would purchase all 5 units and undertake a managed repair of the remaining unit, whilst at the same time tidying up the property and renting out the units at market rates.

Our Calculation:

Gross annual income ($110,000) / Our target yield (10%) = 1.1M – Repairs ($300,000) = Offer $800,000

Chapter 7 – Selling Your As-Is Property Through An Agent vs Selling It Privately

“What do I need to know about selling my As Is Where Is property through an agent?”

Chapter 8 – The Future Of The As Is Where Is Property Market In Christchurch

With still thousands of property deemed unrepaired and many people still in limbo with insurance companies, it is imminent this As Is Where is frenzy will keep rolling over year after year until they are all dried up.

People have been claiming now for the last 5 years, this is the last of it, or it’s all dried up..

We seem to get proven wrong every year

Although the number As Is Where Is listings on TradeMe is down 26% on last year we can’t imagine it is going to pick up in volume, instead just trickle out over time.

The amount of As Is Where Is buyers in the market has also tapered off with the majority of them seeking new strategies in the world of high-density development.

It’s not all doom and gloom as the rising cost of materials & labor has anchored great pressures on the construction industry. We believe for investors who are trying to avoid prolonged delays with council consent and ever-increasing costs to build there is still plenty of opportunity in the Christchurch As Is Where Is property market as the construction cost can be less than 45% of what is required to build a house.

With changes in banking legislation that have tightened borrowing rules which in turn has restricted the flow of capital at low-interest rates, many As Is Where Is buyers and investors will have to turn to second-tier lenders for borrowing where interest rates are 12%, instead of 4%.

Sellers price expectations have increased dramatically following the 35% uplift in house values we have seen over the previous year. This micro boom in Christchurch was at its peak around September, October, November 2021 and since then has begun to taper off. We are seeing more auctions being passed in, half the amount of traffic through open homes and 30% of all local lending cut or declined through application.

The external pressures of COVID have not helped the situation either, with job losses, closure of businesses, and uncertainty throughout the community.

Nevertheless, we can’t hide the fact that there is still a major housing shortage, and demand still outweighs supply. There is still a surplus of capital circulating the economy now that homeowners may be sitting on a fair amount of equity in their homes and the investors have enjoyed the long-awaited lift in property values.

We are seeing the investor market become more hungry than ever for property opportunities and a place to park their money. At the same time the homeowners of As Is Where Is properties are seeking to get a result after years of battling with insurance companies.

It is no surprise there is still a hive of activity in the As Is Where is property market. We predict this will continue to transact in considerable volumes until the foreseeable future.

As always,

Billy